- May 12, 2019

- Posted by: Sutra Management

- Categories: Analytics, Blog posts

No Comments

INTRODUCTION

The International Accounting Standards Board (the Board) issued the standard IFRS 17 in May 2017. This standard sets out the requirements that insurers should comply with in reporting information about insurance contracts issued, reinsurance contracts held and investment contracts with discretionary participation features. Effective January 1, 2022 many regulators have already started directing the insurers for implementing the requirements laid in the standard with gap and impact analysis phases currently underway.

The objective of this new standard is to harmonize insurance accounting across the globe, provide transparency and improve comparability not only within the industry but also outside the industry. It aims to provide information to the users of accounts for understanding meaningfully, the insurers’ financial position, performance and risk exposures. With a new financial presentation, the standard revises the definition of revenue and introduces new disclosures. In addition, given the way the standard changes the look and feel of the financial reports, the new standard is expected to materially impact liability measurement and profit recognition for insurance companies. Hence, IFRS 17 is not just an accounting standard, but it brings in economic aspects to assess the current health and future viability of insurance companies.

IFRS 17 requires a company that issues insurance contracts to report them on the balance sheet as the total of

- Fulfilment cash flows: the current estimates of amounts that the company expects to collect from premiums and pay out for claims, benefits and expenses, including an adjustment for the timing and risk of those amounts;

- Contractual service margin: the expected profit for providing insurance coverage. The expected profit for providing insurance coverage is recognised in profit or loss over time as the insurance coverage is provided.

IFRS 17 requires the company to distinguish between groups of contracts expected to be profit making and groups of contracts expected to be loss making. Any expected losses arising from loss-making, or onerous, contracts are accounted for in profit or loss as soon as the company determines that losses are expected.

Before considering the impact of the new standard on strategic and operational dimensions, lets look at important changes brought in by IFRS 17:

Grouping of Insurance Contracts:

A starting step in the measurement and disclosure process is the grouping of insurance contracts. Grouping based on product characteristics and time dimension (yearly cohorts) has been a practice adopted for long. However, the fundamental change in the requirement is to distinguish and aggregate the contracts which are onerous at recognition from those which do not have a significant probability of becoming onerous subsequently.

The existing practices for computation of revenues are based on the concept of receipt rather than on earned basis. Currently, most insurers present the premiums received, or receivable, as revenue in profit or loss, with a few insurers also reporting deposit components (amount on insurance contracts with investment features paid by the policyholder which is repaid by the insurer even if an insured event does not occur) as revenue.

Computation of Profits

IFRS 17 requires computation of Contractual Service Margins (CSM) which represents the profit that an insurance company expects to receive over the coverage period. CSM is calculated as the present value of the excess of probability weighted cash inflows over the probability weighted and risk adjusted cash outflows. Insurance companies will, thus no longer be able to realize profits upfront at the time of contract issuance but the profits will be tied back to insurance liability component through CSM over the coverage period. Losses will however have to be recognized upfront.

Key components which will alter the profit computation practices are:

•

Discounting of cash flows:

Insurers currently have varied practices; non-life companies with short 1-year contracts not doing discounting to other insurers using risk free rate or certain others using rate of return on underlying assets to discount the cash flows. IFRS 17 requires insurers to use discount rates which reflect the riskiness of cash flows from contracts rather than from rates based on the characteristics of assets backing insurance contracts.

• Risk adjustments:

• Risk adjustments:

Risk adjustments are implicit, and as a result are improperly disclosed or applied selectively whereas the standard makes it explicit with transparent computations.

• Acquisition costs:

• Acquisition costs:

Recognition of acquisition costs as deferred assets will no longer be allowed. Directly attributable acquisition costs will be recognized as cash outflows while computing CSMs.

• Assumptions:

• Assumptions:

To provide transparent and timely information about insurance risks, and changes in those risks, IFRS 17 requires the use of current estimates based on the most up-to-date information available and disclosure of the relevant assumptions for computation of cash flows at every reporting date as opposed to assumptions made at inception being continued.

Under IFRS 17 reinsurance contracts will be valued independently from the underlying contracts.

The standard brings with it new and more transparent sets of reporting and disclosure requirements. Financial statements will need to provide a breakup of components in detail such as the fulfillment cash flows, insurance service result, risk adjustments, CSM and the movement of insurance contract assets and liabilities. Across jurisdictions similar insurance contracts or non-insurance components will be accounted for in a uniform manner. Changes introduced by IFRS 17 will make the insurer’s current financial position and future profitability easier to understand and will enable meaningful comparisons to be made across companies, contracts and industries.

IMPACT

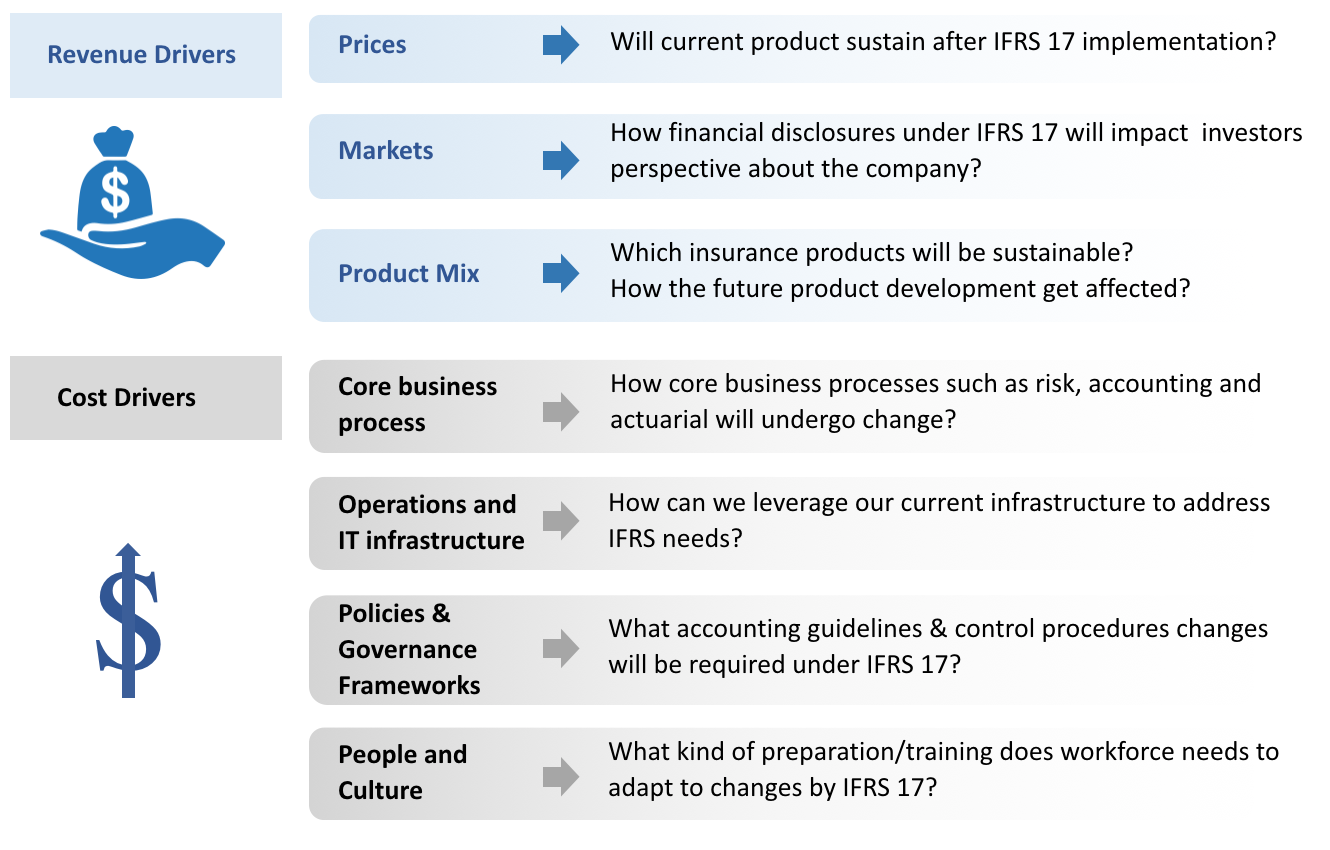

IFRS 17 adoption would have far reaching impacts on the strategic and operational dimensions forcing the insurers to rethink or change the way they have done business. The summary of the impact is depicted in the figure below:

IFRS 17 is impacting key drivers for insurance companies, some of the key strategic questions insurers need to think are…

Existing Insurance products and Future product development

- Life insurance companies will be most affected by IFRS 17 due to the long term nature of the life insurance contracts. Measurement of contracts to reflect economic changes may lead to volatility in earnings of insurers. Life insurance companies might prefer revamping long-term insurance offerings. However, to some extent, this volatility can be reduced by routing such changes in measurement of contracts through OCI option. Aligning with IFRS 9 is thus important.

- Financial benefits of insurance contracts backed by certain type of assets might not be attractive. The contracts are measured based on the characteristics of the liability rather than on those of the assets. Hence, these contracts can lead to volatility

- IFRS 17 is expected to have neutral impact on the property and casualty insurance segment for short term contracts. However, long term contracts will have increased complexity making their accounting treatment more difficult than as of today.

- Products with contracts onerous at inception may need to be relooked at or discontinued

Performance measurement

- The performance of various distribution channels (measured by the written premium collected) will need to undergo a change as will the revenue definition. The new performance measurement matrix will have to be worked out. The entire hierarchy of the sales channel will need to understand this new matrix which will necessitate additional training programs

- Aggressive sales approach in the pursuit of top-line will serve no purpose under the new standard as booking onerous contracts will be viewed negatively than as an achievement

Product Price

- IFRS 17 is expected to change the current pricing methodology since it will have an impact on insurance product features, profitability, duration etc.

- Risk premiums may witness an upward revision with more stringent and transparent computational requirements such as market driven discounting factors and updated economic assumptions backing the cash flows

- Use of mutualization among insurance products to cover for loss making products will no longer be possible with onerous contracts being recognized separately thus forcing insurance companies to revisit product pricing

Capital efficiency

IFRS 17 will reflect the capital efficiency of the insurance companies in a more transparent and balanced manner. Since the standard does not require an overly conservative reserve requirement and since the expense overruns will be charged to CSM, capital efficiency will improve for insurers. At the same time front loading of profits, is not permitted under IFRS 17 as the profits will get adjusted into the CSM and will be released over a period of time. This would lead to a more balanced and transparent view of capital efficiency.

OPERATIONAL IMPACT

IFRS 17 will introduce significant operational complexities for insurance companies. Following operational areas will be majorly impacted:

Data Management

- IFRS 17 will require organizations to maintain wide spectrum of historical, current and future data at a granular level that will be used for grouping of contracts, calculating risk adjustment, discount rates, probabilistic cash flows and resultant CSM calculations and valuation of insurance contracts

- Insurers will need to have comprehensive data management mechanism in place with storage, retrieval, slicing and dicing capabilities with defined data flows and governance controls to achieve the application requirements not only on a retrospective basis upon transition but also on an ongoing basis

- Data integration at various levels will be required to support financial reporting for internal management and more rigorous external reporting & disclosures

Systems

- While planning for IFRS 17 insurers should step back and plan for building greater integration between finance, risk and actuarial through a common platform

- We believe that best way to approach this is through an integrated IFRS 17 solution that connects finance and actuarial systems and publishes the disclosure requirements under the standard

- Insurers can also leverage existing systems by:

- Enhancing current actuarial system to produce CSM calculations, risk adjustments and related data

- Enhancing existing finance systems and IT solutions to cover IFRS 17 specific accounting and reporting requirements

Processes

- Measurement and reporting processes may undergo a change more specifically with respect to:

- Mapping of chart of accounts

- Consolidation, reconciliation and accounting close

- Actuarial computational processes to produce granular level risk adjustments and CSMs

- IT processes under the new system regime related to data mapping and controls

- Disclosure processes

Policy and Governance Frameworks

- New frameworks will have to be created and existing policies may undergo a change namely

- IFRS 17 framework document

- Accounting policy

- Disclosure policy

- Investment policy

- Product programs

People and Culture

The adoption of standard brings its own set of complexities. The conceptual understanding of the standard and the implementation aspects (both at the outset and on an ongoing basis) require upskilling of the finance, data and IT functions. In addition, from a cultural perspective insurance companies will need to be prepared and flexible enough for a more transparent regime wherein performance will be measured and reported based on economic considerations. Better governance and control framework will aid the insurance companies once the standard gets implemented.

IFRS 17 puts a great emphasis on data management strategy, end to end system architecture and modification of policies and processes around finance, actuarial and business functions.

It is imperative for insurers to spend significant time in performing the Gap Analysis and Impact Analysis activities before strategizing on how to implement process and operational changes for adopting the standard.

We at Sutra, an analytics driven advisory firm, have worked with many insurance companies in GCC region in areas of enterprise risk management and analytics, and are fully geared to help companies do a smooth transition to IFRS17 with both advisory and solution implementation services. On the actuarial side, we have also helped many firms in the areas of pricing, product design, reporting, liability valuation, solvency monitoring, asset liability management, business planning amongst others. To know more about our experience, feel free to contact us at Sutra Management website.

About the Authors

Sarthak Agarwal

Sarthak works as an associate with Sutra. He has specialized in organizational performance improvement, operations analytics and Forensics.

Shravan Potnis

Shravan Potnis

Shravan leads risk management practice at Sutra. He is a risk management expert with an experience of more than 17 years in banking and risk consulting.

Sai Srivinas

Mr. Sai Srinivas is a certified actuary having a distinguished career of over 25 years in the insurance industry with more than 10 years in the regulatory role as Appointed Actuary. He is an eminent member of multiple regulatory committees and advisory groups and is a regular speaker in the industry forums.